Sri Lanka Vehicle Import Tax Amendment: New Category for Series Hybrid Electric Vehicles

Understanding the Latest Tax Changes for Fuel-Powered Electric Vehicles

The Sri Lankan government has introduced a significant amendment to vehicle import tax regulations in August 2025, creating a new tax category specifically for series hybrid electric vehicles that use fuel-powered motors. This change addresses a critical gap in the existing tax structure and has important implications for vehicle importers.

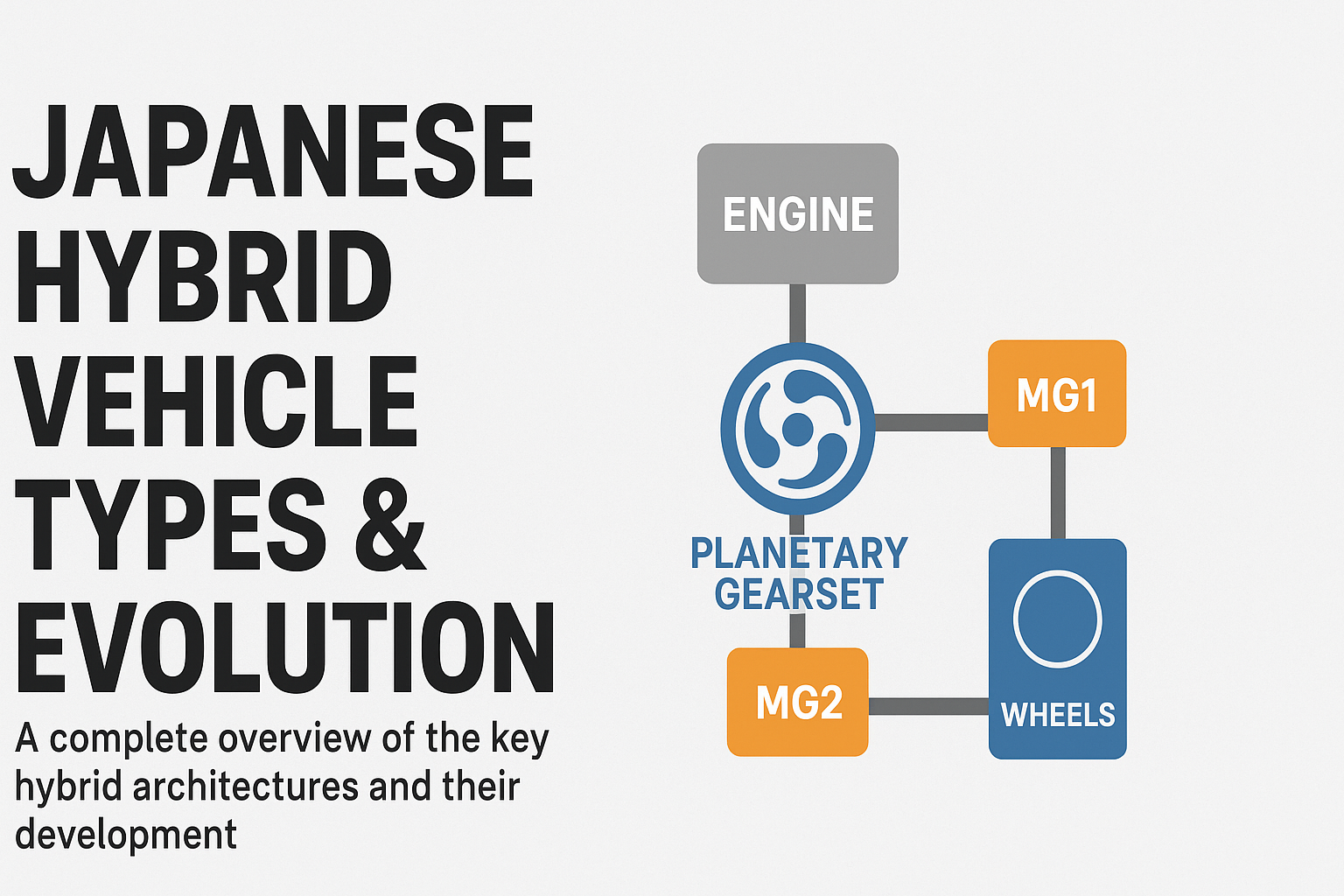

What Are Series Hybrid Vehicles?

Before diving into the tax details, it's essential to understand what series hybrid vehicles are:

Key Characteristics:

- Electric motors drive the wheels exclusively - The gasoline/diesel engine never directly powers the wheels

- Engine acts as a generator - The fuel engine only generates electricity to charge the battery

- Multiple electric motors - Can have electric motors at two wheels (front or rear) or four wheels (all-wheel drive)

- Battery acts as energy buffer - Stores electricity from both the engine-generator and regenerative braking

How It Works:

- Fuel engine runs a generator

- Generator produces electricity

- Electricity charges the battery pack

- Battery powers electric motors at the wheels

- Motors drive the vehicle forward

Common Examples: BMW i3 with range extender, Fisker Karma, certain plug-in hybrid electric vehicles (PHEVs)

Why the Amendment Was Necessary

The Problem

According to Deputy Minister of Labour and Economic Development Dr. Anil Jayantha Fernando, series hybrid vehicles were falling into a regulatory gap:

- These vehicles didn't fit existing categories (petrol, diesel, standard hybrid, or pure electric)

- No proper Harmonized System (HS) code existed for classification

- Result: Importers were paying disproportionately high taxes under general categories

The Solution

The Cabinet approved a committee to:

- Create a new vehicle classification system

- Develop updated HS codes

- Establish fair tax rates for series hybrid vehicles

New Tax Structure for Series Hybrid Vehicles

Tax Components Breakdown

| Tax Component | Rate/Details | Applied To |

|---|---|---|

| CIF Base Value | Total cost of vehicle at port | All vehicles |

| Customs Import Duty (CID) | 20% of CIF | All vehicles |

| Surcharge on CID | 50% of CID (effectively making total CID 30%) | All vehicles |

| Port & Aviation Levy (PAL) | 10% of base | All vehicles |

| Excise Duty (XID) | Variable by motor power (kW) | Electric motors |

| Luxury Tax | 60% if CIF > Rs. 6 million | High-value vehicles |

| VAT | 18% on total of above | Final calculation |

Luxury Tax Thresholds

| Vehicle Type | Luxury Tax Threshold |

|---|---|

| Electric Vehicles (EV) | Rs. 6,000,000 |

| New Series Hybrid Category | Rs. 6,000,000 |

| Petrol Vehicles | Rs. 5,500,000 |

| Diesel Vehicles | Rs. 5,000,000 |

The luxury tax is applied at 60% only on the amount exceeding the threshold

Key Benefits of the New Amendment

1. Reduced Tax Burden for Lower-Cost Vehicles

The new classification ensures that affordable series hybrid vehicles are not overtaxed due to improper categorization.

2. Fair Classification

Vehicles are now taxed according to their actual technology and capabilities rather than being forced into unsuitable categories.

3. Appropriate Luxury Vehicle Taxation

High-end series hybrid vehicles with CIF values above Rs. 6 million will face luxury taxes, ensuring premium vehicles contribute appropriately.

4. Encourages Modern Vehicle Technology

By creating proper categories, Sri Lanka is preparing its import regulations for emerging vehicle technologies.

Excise Duty Rates for Electric Motors

Recent gazette notifications (2434/04) have updated excise duty rates for electric vehicles:

| Motor Power Range | Excise Duty Rate |

|---|---|

| Up to 100 kW | Rs. 8,500 per kW |

| 100-150 kW | Progressive rates |

| Above 150 kW | Rs. 18,500-144,900 per kW |

Important Note: These rates represent a significant increase (210%-1600%+) from previous schedules, reflecting the government's updated tax policy on electric vehicle imports.

Calculation Example: Series Hybrid Vehicle

Let's calculate the total import cost for a series hybrid vehicle with:

- CIF Value: Rs. 4,500,000

- Motor Power: 120 kW

- Luxury threshold: Rs. 6,000,000

Step-by-Step Calculation:

| Step | Description | Amount (Rs.) | Running Total (Rs.) |

|---|---|---|---|

| 1 | CIF Value (Base) | - | 4,500,000 |

| 2 | CID (20% of CIF) | 900,000 | 5,400,000 |

| 3 | Surcharge (50% of CID) | 450,000 | 5,850,000 |

| 4 | PAL (10% of base) | 450,000 | 6,300,000 |

| 5 | Excise Duty (varies by kW) | ~1,200,000 | 7,500,000 |

| 6 | Luxury Tax (0 - below threshold after adjustments) | 0 | 7,500,000 |

| 7 | VAT (18% of total) | 1,350,000 | 8,850,000 |

Total Import Cost: Approximately Rs. 8,850,000

Note: This is an estimate. Actual calculations may vary based on specific HS codes and latest gazette rates.

Important Points for Vehicle Importers

✅ What You Need to Know:

- Only RMV-registered importers can import vehicles - no personal imports allowed

- No tax concession permit imports under current regulations

- Proper vehicle classification is critical - ensure your series hybrid is correctly categorized

- HS code accuracy matters - the new codes determine your tax liability

- CIF value must be accurate - includes cost, insurance, and freight

🚨 Common Mistakes to Avoid:

- Misclassifying series hybrids as standard hybrids or pure EVs

- Underestimating motor power specifications

- Not accounting for all tax components in import budgets

- Ignoring the luxury tax threshold when importing premium vehicles

How to Calculate Your Vehicle Import Tax

Use Online Calculators:

Visit jpchecker.com/pages/Calculator for an accurate, instant calculation of your vehicle import taxes based on:

- Latest 2025 gazette rates

- All applicable taxes (CID, Surcharge, PAL, XID, Luxury Tax, VAT)

- Series hybrid classifications

- Real-time exchange rates

Manual Calculation Formula:

Total Cost = CIF + CID + Surcharge + PAL + XID + Luxury Tax + VAT

Where:

- CID = 20% of CIF

- Surcharge = 50% of CID (10% of CIF)

- PAL = 10% of CIF

- XID = Based on motor power (kW)

- Luxury Tax = 60% of (CIF - Threshold) if applicable

- VAT = 18% of running total

Latest Updates and Official Gazettes

Key Gazette Notifications:

- Gazette 2421/44 - Vehicle import ban lifted (February 1, 2025)

- Gazette 2434/04 - Updated excise duty rates for electric vehicles

- August 2025 - New category for fuel-powered electric vehicles approved

Stay Updated:

- Check Sri Lanka Customs official website regularly

- Monitor gazette notifications

- Consult with registered vehicle importers

- Use updated tax calculators like jpchecker.com

Frequently Asked Questions (FAQ)

Q1: What's the difference between a series hybrid and a regular hybrid?

A: In a series hybrid, only electric motors drive the wheels, and the fuel engine acts as a generator. In regular (parallel) hybrids, both the engine and electric motor can directly power the wheels.

Q2: Can I import a series hybrid vehicle for personal use?

A: No. Current regulations only allow RMV-registered importers to import vehicles. Personal imports are not permitted.

Q3: How do I know if my vehicle qualifies as a series hybrid?

A: Check the vehicle specifications. Series hybrids have electric motors at the wheels with a fuel engine that only generates electricity, not mechanical drive power.

Q4: Will the luxury tax apply to all series hybrid vehicles?

A: No. Luxury tax only applies if the CIF value exceeds Rs. 6 million. Only the amount above this threshold is taxed at 60%.

Q5: Are there any environmental benefits to importing series hybrid vehicles?

A: Yes. Series hybrids typically achieve better fuel efficiency and lower emissions in stop-and-go city driving compared to traditional vehicles.

Conclusion

The new tax amendment for series hybrid electric vehicles represents a significant step forward in Sri Lanka's vehicle import regulations. By creating a proper classification system, the government has:

- ✅ Reduced unfair tax burdens on importers

- ✅ Created clarity in vehicle categorization

- ✅ Prepared the framework for emerging vehicle technologies

- ✅ Ensured appropriate taxation of luxury models

For vehicle importers, this means:

- More predictable tax calculations

- Fair treatment of modern hybrid technologies

- Better import planning capabilities

Calculate Your Vehicle Import Tax Now

Visit jpchecker.com/pages/Calculator for instant, accurate tax calculations based on the latest 2025 regulations.

Related Resources

- Sri Lanka Customs Official Website

- Latest Vehicle Import Gazette Notifications

- Ministry of Finance Tax Guidelines

- jpchecker.com Vehicle Tax Calculator

Last Updated: December 2025

Disclaimer: Tax rates and regulations are subject to change. Always verify with official sources and consult with registered importers before making import decisions.