Complete Guide to Sri Lanka Vehicle Excise Duty 2025

Last Updated: January 2025

Are you planning to import or purchase a vehicle in Sri Lanka? Understanding the excise duty structure is crucial for making an informed decision. This comprehensive guide breaks down everything you need to know about Sri Lanka's vehicle excise duty rates for 2025.

What is Vehicle Excise Duty?

Vehicle excise duty is a tax levied on motor vehicles in Sri Lanka, whether imported or locally manufactured. The duty amount varies based on several factors including vehicle type, engine capacity, fuel type, age, and manufacturing origin.

Key Factors That Determine Excise Duty

1. Vehicle Type

- Passenger cars (HS Code 8703)

- Buses and vans (HS Code 8702)

- Cargo vehicles/trucks (HS Code 8704)

- Motorcycles (HS Code 8711)

- Special purpose vehicles (HS Code 8705)

2. Engine Capacity

For petrol and diesel vehicles, duty is calculated based on cubic centimeters (cc or cm³):

- Up to 1,000cc

- 1,001cc - 1,500cc

- 1,501cc - 2,000cc

- 2,001cc - 3,000cc

- Above 3,000cc

3. Vehicle Age

Age significantly impacts duty rates, with brackets typically at:

- Not more than 1 year

- Not more than 2 years

- Not more than 3 years

- And continuing up to 10+ years

4. Fuel Type

Different rates apply for:

- Fossil fuel vehicles (petrol/diesel)

- Hybrid vehicles (dual power systems)

- Electric vehicles (battery-powered)

Excise Duty Rates for Popular Vehicle Categories

Passenger Cars (HS Code 8703)

Small Cars (Up to 1,000cc - Petrol)

- Not more than 3 years old: Rs. 1,992,000 per unit OR Rs. 2,450 per cc

- More than 3 years old: Rs. 1,992,000 per unit OR Rs. 2,450 per cc

Example: For a 1,000cc car

- Duty calculation: 1,000cc × Rs. 2,450 = Rs. 2,450,000

- OR flat rate: Rs. 1,992,000

- You pay the higher amount: Rs. 2,450,000

Mid-Size Cars (1,001cc - 1,500cc - Petrol)

- 1,001cc - 1,300cc: Rs. 3,850 per cc

- 1,301cc - 1,500cc: Rs. 4,450 per cc

Example: For a 1,300cc car not more than 3 years old

- Duty: 1,300cc × Rs. 3,850 = Rs. 5,005,000

Large Cars (1,501cc - 2,000cc - Petrol)

- Up to 1,600cc: Rs. 5,150 per cc

- 1,601cc - 1,800cc: Rs. 6,400 per cc

- 1,801cc - 2,000cc: Rs. 7,700 per cc

Luxury Cars (Above 2,000cc - Petrol)

- 2,001cc - 2,500cc: Rs. 8,450 per cc

- 2,501cc - 2,750cc: Rs. 9,650 per cc

- 2,751cc - 3,000cc: Rs. 10,850 per cc

- 3,001cc - 4,000cc: Rs. 12,050 per cc

- Above 4,000cc: Rs. 13,300 per cc

Diesel Vehicles

Diesel vehicles typically have higher duty rates:

Small Diesel (Up to 1,500cc)

- Rs. 5,550 per cc (regardless of age up to 3 years)

Medium Diesel (1,501cc - 2,500cc)

- Up to 1,600cc: Rs. 6,950 per cc

- 1,601cc - 1,800cc: Rs. 8,300 per cc

- 1,801cc - 2,000cc: Rs. 9,650 per cc

- 2,001cc - 2,500cc: Rs. 9,650 per cc

Large Diesel (Above 2,500cc)

- 2,501cc - 2,750cc: Rs. 10,850 per cc

- 2,751cc - 3,000cc: Rs. 12,050 per cc

- 3,001cc - 4,000cc: Rs. 13,300 per cc

- Above 4,000cc: Rs. 14,500 per cc

Electric Vehicles (Battery-Powered)

Electric vehicles are taxed based on motor capacity in kilowatts (kW):

New EVs (Not more than 1 year old)

- Up to 50kW: Rs. 9,050 per kW

- 51kW - 100kW: Rs. 12,050 per kW

- 101kW - 200kW: Rs. 18,100 per kW

- Above 200kW: Rs. 48,300 per kW

EVs (1-3 years old)

- Up to 50kW: Rs. 18,100 per kW

- 51kW - 100kW: Rs. 18,100 per kW

- 101kW - 200kW: Rs. 30,200 per kW

- Above 200kW: Rs. 66,400 per kW

EVs (More than 3 years old)

- Up to 50kW: Rs. 24,150 per kW

- 51kW - 100kW: Rs. 36,200 per kW

- 101kW - 200kW: Rs. 54,350 per kW

- Above 200kW: Rs. 72,450 per kW

Example: For a 75kW electric car (1 year old)

- Duty: 75kW × Rs. 12,050 = Rs. 903,750

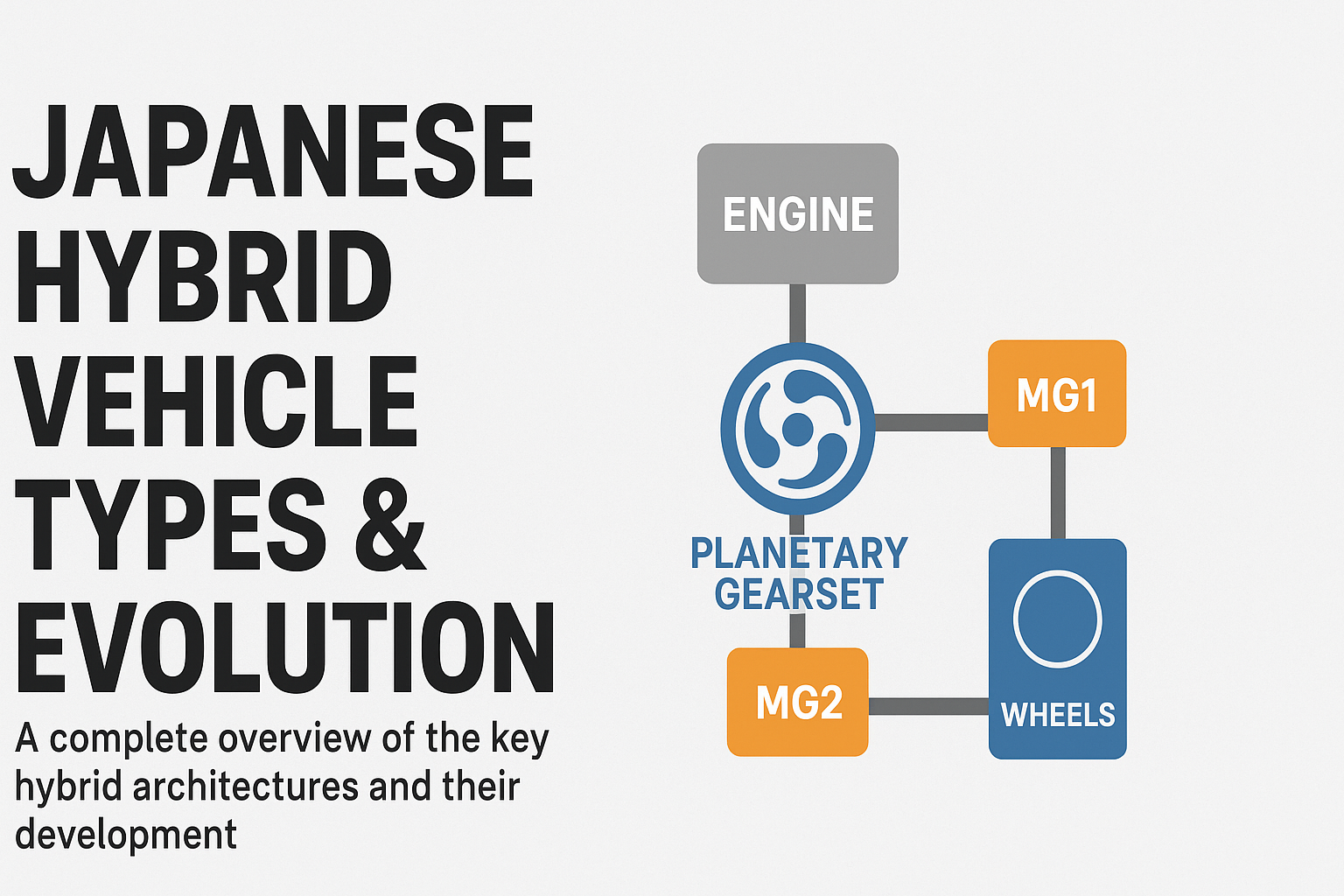

Hybrid Vehicles

Hybrid vehicles enjoy lower duty rates compared to pure fossil fuel vehicles:

Small Hybrid (Up to 1,500cc)

- 1,001cc - 1,300cc: Rs. 2,750 per cc

- 1,301cc - 1,500cc: Rs. 3,450 per cc

Medium Hybrid (1,501cc - 2,000cc)

- Up to 1,600cc: Rs. 4,800 per cc

- 1,601cc - 1,800cc: Rs. 6,300 per cc

- 1,801cc - 2,000cc: Rs. 6,900 per cc

Motorcycles (HS Code 8711)

Small Motorcycles (Up to 250cc)

- Up to 50cc, ≤3 years: Rs. 700 per cc

- 51cc - 200cc, ≤3 years: Rs. 1,400 per cc

- 201cc - 250cc, ≤3 years: Rs. 2,050 per cc

Medium Motorcycles (251cc - 500cc)

- 251cc - 350cc, ≤3 years: Rs. 2,050 per cc

- 351cc - 450cc, ≤3 years: Rs. 2,750 per cc

- 451cc - 500cc, ≤3 years: Rs. 2,750 per cc

Large Motorcycles (Above 500cc)

- 501cc - 800cc, ≤3 years: Rs. 3,500 per cc

- 801cc - 1,000cc, ≤3 years: Rs. 3,500 per cc

- Above 1,000cc, ≤3 years: Rs. 4,200 per cc

Electric Motorcycles

- Not more than 3 years old: Rs. 9,050 per kW

- More than 3 years old: Rs. 18,100 per kW

Three-Wheelers (Auto-Trishaws)

Petrol Three-Wheelers

- Rs. 2,900 per cc (regardless of age)

Diesel Three-Wheelers

- Rs. 1,750 per cc

Electric Three-Wheelers

- Not more than 2 years old:

- Rs. 9,050 per kW (≤1 year)

- Rs. 12,050 per kW (1-2 years)

- More than 2 years old: Rs. 18,100 per kW

Special Concessions and Reduced Rates

1. Government Officials

Senior government officials receive substantial duty reductions:

- Group I: Deduct Rs. 22 million from payable duty

- Group II: Deduct Rs. 16 million from payable duty

- Group III: Deduct Rs. 12 million from payable duty

2. Diplomatic Officers

Sri Lankan diplomatic officers who have served abroad:

- Deduct Rs. 3.6 million from payable duty

3. Vehicle Exporters

Exporters meeting specific criteria:

- Pay only 50% of the normal duty

4. Locally Assembled Vehicles

Vehicles with Domestic Value Addition (DVA) receive reduced rates based on a special matrix system.

Domestic Value Addition (DVA) Matrix System

For locally manufactured or assembled vehicles, duty rates are significantly reduced based on:

- DVA percentage (20%-75%+)

- Vehicle age (up to 18 years)

- Energy technology (Fossil/Hybrid/Electric)

DVA Rate Examples:

| DVA Level | Fossil Fuel (Year 1-2) | Hybrid (Year 1-2) | Electric (Year 1-2) |

|---|---|---|---|

| Below 20% | 100% | 100% | 100% |

| 40-44% | 20% | 17.5% | 15% |

| 55-59% | 12.5% | 10% | 10% |

| Above 60% | 10% | 10% | 10% |

Higher DVA means lower duty rates, encouraging local manufacturing.

Commercial Vehicles

Buses (HS Code 8702)

Small Buses (Less than 13 passengers)

- Diesel, ≤3.5 years: 200% duty

- Hybrid, ≤3.5 years: 200% duty

- Electric, ≤3.5 years: 200% duty

Medium Buses (13-24 passengers)

- Diesel, ≤5 years: Rs. 5,432,650 per unit

- Hybrid, ≤5 years: Rs. 5,130,850 per unit

- Electric, ≤5 years: Rs. 4,225,400 per unit

Large Buses (25+ passengers)

- ≤10 years: Rs. 1,810,900 per unit

- >10 years: Rs. 3,018,150 per unit

Cargo Vehicles/Trucks (HS Code 8704)

Light Trucks (GVW ≤5 tonnes)

- Diesel, ≤4 years: Rs. 724,350 - Rs. 6,036,300 per unit (depending on configuration)

- Electric, ≤5 years: Rs. 9,050 - Rs. 48,300 per kW

Medium Trucks (GVW 5-20 tonnes)

- ≤5 years: Rs. 1,207,250 per unit

- 5-10 years: Rs. 3,018,150 per unit

- >10 years: Rs. 4,829,050 per unit

Heavy Trucks (GVW >20 tonnes)

- Similar rates to medium trucks

Other Excise Duties

Beverages

- Mineral/aerated waters: Rs. 31 per liter

- Sugary drinks: Rs. 15 per liter OR 36 cents per gram of sugar (whichever is higher)

- Energy drinks: Rs. 15 per liter OR 36 cents per gram of sugar (whichever is higher)

Tobacco Products

- Cigarettes (≤60mm): Rs. 19,350 per 1,000 cigarettes

- Cigarettes (>84mm): Rs. 90,050 per 1,000 cigarettes

- Cigars: Rs. 9,660 per kg

Petroleum Products

- Petrol (all octane ratings): Rs. 72 per liter

- Super Diesel: Rs. 57 per liter

- Regular Diesel: Rs. 50 per liter

Appliances

- Refrigerators: 20-25% duty

- Washing machines: 25% duty

- Dishwashers: 30% duty

How to Calculate Your Vehicle Duty

Step-by-Step Calculation

Example 1: Petrol Car (1,500cc, 2 years old)

- Identify vehicle specifications: 1,500cc petrol, 2 years old

- Find applicable rate: Rs. 4,450 per cc (1,301-1,500cc range)

- Calculate: 1,500cc × Rs. 4,450 = Rs. 6,675,000

Example 2: Electric Vehicle (80kW, 1.5 years old)

- Identify specifications: 80kW electric, 1.5 years old

- Find applicable rate: Rs. 18,100 per kW (1-3 years, 51-100kW)

- Calculate: 80kW × Rs. 18,100 = Rs. 1,448,000

Example 3: Diesel SUV (2,500cc, 3 years old)

- Identify specifications: 2,500cc diesel, 3 years old

- Find applicable rate: Rs. 9,650 per cc

- Calculate: 2,500cc × Rs. 9,650 = Rs. 24,125,000

Important Tips for Vehicle Buyers

1. Consider Electric or Hybrid

Electric and hybrid vehicles have significantly lower duty rates compared to fossil fuel vehicles, especially for newer models.

2. Vehicle Age Matters

Newer vehicles (especially under 1 year) enjoy lower rates for electric vehicles. However, for conventional vehicles, age may not impact rates as much within the first 3 years.

3. Engine Size is Crucial

The duty increases dramatically with engine capacity. A 2,000cc vehicle costs nearly double the duty of a 1,500cc vehicle.

4. Use Official Calculators

Always verify calculations using official tools like JPChecker.com to get accurate estimates.

5. Check for Eligibility

If you qualify for any special permits or concessions, you could save millions of rupees in duty.

6. Consider Total Cost of Ownership

Beyond excise duty, factor in:

- Annual license fees

- Insurance costs

- Fuel/electricity costs

- Maintenance expenses

Frequently Asked Questions

Q: Can I import any vehicle to Sri Lanka?

A: No, there are restrictions based on vehicle age and type. Check current import regulations before purchasing.

Q: Are used vehicles more expensive in duty?

A: Generally, yes. Older vehicles face higher duty rates, especially those over 3 years old.

Q: How is hybrid vehicle duty calculated?

A: Hybrid vehicles are taxed based on their internal combustion engine capacity (cc), but at lower rates than pure fossil fuel vehicles.

Q: Can I get a refund if I overpay duty?

A: Duty payments should be calculated accurately upfront. Consult with customs authorities for any disputes.

Q: Do I pay excise duty on locally purchased vehicles?

A: If the vehicle was previously imported and duty paid, you typically don't pay again. However, verify with the seller and authorities.

Conclusion

Sri Lanka's vehicle excise duty system for 2025 is complex but understandable once you know the key factors. Electric vehicles offer the most attractive duty rates, especially for newer models, while larger fossil fuel vehicles carry significantly higher duties.

Before making any vehicle purchase or import decision:

- Calculate the exact duty using your vehicle's specifications

- Check if you qualify for any concessions

- Compare total ownership costs across different vehicle types

- Verify all information with official customs sources

Need help calculating your vehicle duty? Use our free calculator at JPChecker.com for instant, accurate estimates!

Disclaimer: This guide is based on the gazette notification dated January 10, 2025. Duty rates and regulations may change. Always verify with official government sources before making financial decisions.

Sources:

- Sri Lanka Customs Department

- Extraordinary Gazette G.N 2418-43 dated 10.01.2025

- Ministry of Finance, Sri Lanka